Simplify Your Finances: How to Submit Your Online Income Tax Return in Australia

Filing your on-line tax return in Australia need not be an overwhelming task if come close to carefully. Comprehending the details of the tax system and effectively preparing your records are vital initial steps. Selecting a trustworthy online system can improve the process, however lots of forget crucial details that can affect their general experience. This conversation will certainly discover the essential parts and strategies for simplifying your finances, ultimately resulting in a much more effective filing process. What are the common mistakes to prevent, and exactly how can you make sure that your return is compliant and accurate?

Understanding the Tax Obligation System

To navigate the Australian tax system properly, it is crucial to realize its basic principles and structure. The Australian tax obligation system operates a self-assessment basis, implying taxpayers are responsible for accurately reporting their revenue and determining their tax obligations. The major tax authority, the Australian Taxation Workplace (ATO), manages compliance and applies tax obligation laws.

The tax obligation system makes up various parts, including income tax obligation, services and items tax (GST), and capital gains tax obligation (CGT), to name a few. Specific earnings tax obligation is modern, with prices enhancing as revenue increases, while corporate tax obligation prices differ for small and big businesses. In addition, tax offsets and reductions are available to minimize gross income, allowing for even more customized tax responsibilities based on individual circumstances.

Knowledge tax obligation residency is also critical, as it figures out a person's tax responsibilities. Homeowners are exhausted on their globally income, while non-residents are only strained on Australian-sourced income. Experience with these concepts will certainly empower taxpayers to make educated decisions, ensuring compliance and possibly maximizing their tax results as they prepare to submit their on-line tax returns.

Preparing Your Documents

Collecting the necessary files is a critical action in preparing to file your online tax return in Australia. Appropriate documents not just simplifies the filing procedure yet additionally ensures accuracy, reducing the danger of mistakes that might cause fines or hold-ups.

Begin by collecting your income statements, such as your PAYG payment summaries from employers, which detail your earnings and tax withheld. online tax return in Australia. Guarantee you have your service earnings documents and any type of appropriate invoices if you are self-employed. Additionally, collect financial institution declarations and paperwork for any type of interest earned

Following, assemble records of deductible expenses. This might consist of receipts for work-related expenses, such as attires, travel, and tools, along with any kind of academic expenses related to your career. Ensure you have documentation for rental revenue and connected expenditures like fixings or residential property administration costs. if you have residential or commercial property.

Do not fail to remember to consist of other relevant papers, such as your medical insurance details, superannuation payments, and any financial investment income declarations. By meticulously organizing these records, you set a strong structure for a smooth and reliable online tax return procedure.

Selecting an Online Platform

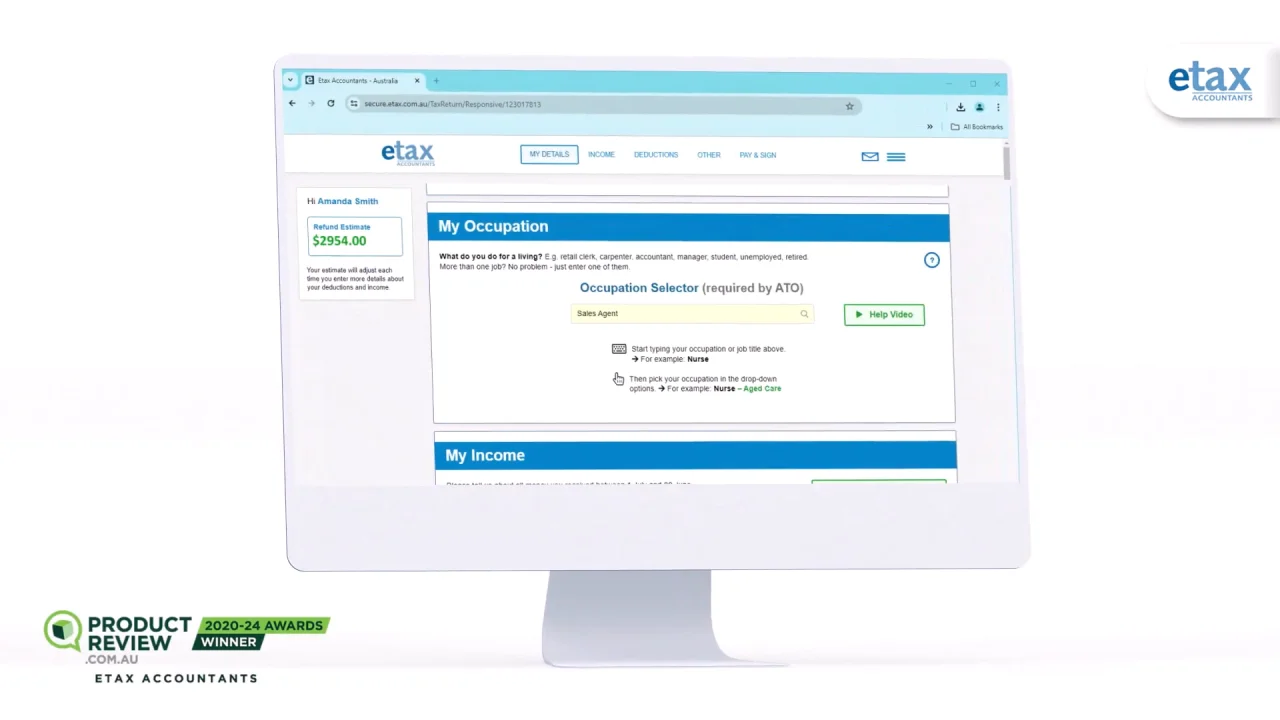

After arranging your documentation, the next action includes picking a suitable online system for filing your tax obligation return. online tax return in Australia. In Australia, several reputable platforms are readily available, each offering distinct attributes tailored to different taxpayer demands

When choosing an on the internet system, consider the customer interface and convenience of navigation. A simple layout can considerably improve your experience, making it simpler to input your info properly. Additionally, make certain the platform is compliant with the Australian Tax Workplace (ATO) regulations, as this will ensure that your entry fulfills all lawful requirements.

One more essential factor is the availability of client support. Systems using real-time talk, phone assistance, or comprehensive FAQs can offer useful help if you run into obstacles throughout the declaring procedure. Evaluate the safety and security steps in place to safeguard your personal information. Look for platforms that make use of security and have a strong personal privacy policy.

Lastly, think about the costs related to numerous systems. While some may offer free solutions for fundamental income tax return, others might bill fees for innovative functions or extra assistance. Evaluate these elements to select the system that aligns ideal with your monetary situation and declaring requirements.

Step-by-Step Filing Procedure

The step-by-step filing procedure for your on the internet income tax return in Australia is created to improve the entry of your economic information while making certain compliance with ATO regulations. Started by gathering all needed files, including your revenue statements, financial institution statements, and any kind of receipts for reductions.

Once you have your records ready, visit to your chosen online system and create or access your account. Input your individual information, including your Tax obligation File Number (TFN) and get in touch with information. Next, enter your revenue details precisely, ensuring to consist of all incomes such as incomes, rental income, or investment revenues.

After describing your income, go on to assert eligible reductions. This might include job-related expenditures, philanthropic donations, and medical expenditures. Make certain to evaluate the ATO standards to optimize your claims.

When all details is entered, very carefully assess your return for accuracy, fixing any kind of redirected here disparities. After ensuring whatever is right, send your tax obligation return electronically. You will get a confirmation of entry; maintain this for your documents. Finally, check your account for any kind of updates from the ATO regarding your income tax return status.

Tips for a Smooth Experience

Finishing your on-line tax obligation return can be a straightforward process with the right prep work and state of mind. To make sure a smooth experience, start by gathering all required files, Full Report such as your income declarations, receipts for deductions, and any type of various other pertinent monetary records. This organization minimizes mistakes and conserves time throughout the declaring process.

Following, acquaint yourself with the Australian Taxes Office (ATO) website and its on-line services. Utilize the ATO's sources, including overviews and FAQs, to clarify any kind of uncertainties prior to you start. online tax return in Australia. Consider establishing a MyGov account linked to the ATO for a structured filing experience

In addition, capitalize on the pre-fill capability provided by the ATO, which automatically occupies some of your info, reducing the opportunity of mistakes. Guarantee you double-check all entrances for precision before entry.

If issues emerge, don't hesitate to seek advice from a tax obligation specialist or make use of the ATO's assistance services. Following these suggestions can lead to a convenient and effective on-line tax obligation return experience.

Conclusion

To conclude, filing an online income tax return in Australia can be streamlined through cautious prep work and choice of check out here proper sources. By comprehending the tax obligation system, arranging needed papers, and selecting a certified online platform, individuals can navigate the filing process effectively. Following an organized strategy and making use of readily available assistance makes sure precision and maximizes eligible deductions. Ultimately, these techniques add to an extra effective tax filing experience, streamlining economic administration and improving compliance with tax obligation commitments.

Comments on “Step-by-Step Instructions for Completing Your Online Tax Return in Australia Without Mistakes”